By:

Published: September, 2022

The COVID-19 pandemic laid bare systemic weaknesses that impede access to and sufficient levels of unemployment insurance (UI) benefits, even in strong economic times. It illuminated the disproportionate risks facing women workers, workers of color, and low-wage workers whose benefits are far too low to sustain them through the search for a new job and the lack of protection for the growing number of workers in “non-standard” jobs – part-time, contract, and so-called “gig” work.

What has been less visible is the degree to which our UI system is ill-structured to meet the unique needs of another growing group of employees – older workers.

Why is it especially hard for people aged 50+ when they lose their jobs?

- Ageism and discrimination: Fifty is the age at which age discrimination becomes particularly pervasive, making it harder to land a new job after one is lost. Because those over fifty have more work experience, and their labor costs more, on average, than that of their younger peers, older workers are more likely to be let go.

- Health challenges: Fifty is also the age at which chronic health problems may become more severe, and acute ailments that make work difficult – from joint and back pain to cancers – become more common and can be disabling.

- Caregiving responsibilities: Many older workers care for young adult children, grandchildren, aging spouses and/or ailing parents while trying to hold down a full-time job. Lack of options for affordable caregiving pushes many to cut back their working hours or leave the workforce altogether.

- Hard labor: And, of course, for the tens of millions of workers whose jobs involve arduous activity, fifty may be the point at which their jobs become too taxing for their bodies’ capacities. Because these tend to be workers with less formal education, they find it difficult, even impossible, to find new jobs that match their physical capacity and qualifications.

All of these factors undermine older workers’ capacity to save for dignified, stable retirements.

The UI system is not designed to accommodate the realities older workers face, making it more difficult to obtain protection.

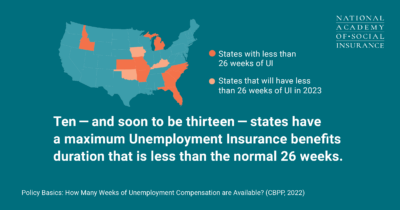

- Twenty-six weeks of normal UI benefits is too short a duration for older workers. The maximum duration is even lower in ten states (AL, AR, FL, GA, ID, KS, MI, MO, NC, and SC), and three more – IA, KY, and OK – will reduce duration next year.1 While twenty-six weeks is sufficient for most prime-age workers who lose their jobs during strong economic times, a growing number exhaust their benefits during recessions, when most UI claims are filed. And older workers, who are much more likely than younger workers to exhaust regular benefits (27% vs. 20%) and to leave the labor force altogether after a layoff (25% vs. just 10%), may need a full year to land new jobs (O’Leary and Wandner 2000). They also may need targeted help to overcome ageism and other barriers to getting those jobs (White, 2021).

- Many older workers incur large costs associated with unemployment that UI benefits do not cover. For the more than half of U.S. workers whose health insurance is provided by their employers, losing a job means losing that insurance and, potentially, coverage for a spouse and children (KFF 2021). This burden is especially heavy for older, less healthy, and more expensive-to-cover, workers.

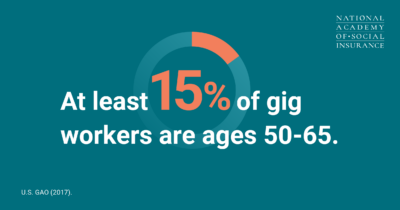

- Older workers are among the “non-standard” workers who are often not eligible for UI benefits. A growing share of older workers are contractors, gig workers, or self-employed, in many cases due to their struggles to find viable regular employment that would support them. According to data from a Pew Research survey, at least 15% of gig workers – who earn money via online platforms – are aged 50-65 (USGAO 2017). In most states, these workers are not eligible for UI benefits, an issue that only a handful of states is currently working to address.

- The COVID-19 recession hit older workers harder, rendering them jobless but not eligible for UI. Preliminary evidence suggests the impacts from the pandemic downturn may be most severe for older workers (Ghilarducci 2022). In particular, older workers of color with little formal education were faced with impossible choices: with jobs that did not allow them to safely work from home, they were forced either to expose themselves to the risk of illness or even death on a daily basis, or to quit, with few resources to rely on.

- Older workers of color are disproportionately harmed by all of these factors. On average, Black workers are jobless nearly as long as older workers overall. Black, Latinx, and indigenous older workers are disproportionately in non-standard work arrangements that render them ineligible for UI benefits, have less formal education and thus fewer options for finding new jobs, and have much less in the way of assets to help them get by in the meantime.

Five options for enhanced and targeted policy changes would help close these gaps.

- Establish a longer maximum duration for older claimants. As SSA provides applicants for Social Security Disability Insurance (DI)

aged 50 and older accommodations, the UI program could establish a longer maximum duration for older claimants based on evidence of how long it takes them, on average, to find a suitable new job. This could be further expanded during recessions, when benefits are often increased and/or extended. - Create a targeted new Social Security benefit. A new Social Security benefit for older workers who can no longer do physically difficult jobs but are not eligible for Disability Insurance (DI) or Supplemental Security Income (SSI) would bridge the gap between late-50s joblessness and Full Retirement Age (Vallas and Weller 2019). It would also reduce the penalty disproportionately incurred by workers of color, women, immigrants, and workers with little education who are forced to “retire” early.

- Enhance UI coverage for gig and other non-standard and part-time workers. States offer multiple approaches to ensure that gig and non-standard workers–whose daily activities often look a lot like regular employment–are protected like their formally employed counterparts. There are also models for boosting benefits for part-time workers. Federal reforms to the UI program could ensure that workers in all states are better protected.

- Address health care coverage gaps caused by job loss through Medicare and ACA expansion. As Congress assesses options to expand Medicare and the ACA, it could explore tailored supports through one or both programs for older workers who lose their health insurance when they lose their jobs.

- Improve coordination among federal and state departments and agencies. The Social Security Administration, Department of Labor, and others could enhance targeted support for jobless older workers, as they already do for women workers and other groups, by helping them train for and land viable new jobs. Improving the enforcement of age-discrimination provisions and federal guidelines might reduce the number of older workers who involuntarily retire, especially during and in the aftermath of recessions, and older workers who were wrongfully dismissed could collect UI benefits.

The Bottom Line

UI has the foundation in place to support older jobless workers, but nearly a century after it was established, it needs updating. In addition to better supporting workers aged 50 and older, who constitute a growing share of the labor force, a modern UI system must support workers of color and immigrants whose participation in labor has long been neglected, the women workers who outnumber men in many occupations, and workers experiencing the effects of a rapidly shifting worker-employer relationship. The participation of these workers is critically important to sustain our labor force, so our UI system must support their efforts to continue to work and, as and when needed, to ease into retirement.

The Pathways to Economic Security toolkit is a series of resources, including this fact sheet, to provide policymakers, advocates, administrators, and other stakeholders with key facts to help improve the social insurance programs that protected millions of Americans during the pandemic. Learn more about the COVID-19 Task Force Policy Translation Working Group. This Task Force is part of the Academy’s Pathways to Economic Security campaign.

References

Center on Budget and Policy Priorities (2022). Policy Basics: How Many Weeks of Unemployment Compensation are Available? Policy Basics: How Many Weeks of Unemployment Compensation Are Available?

Ghilarducci, Teresa (2022). “What’s Going on With Older Workers?” Forbes. April 28.

Kaiser Family Foundation (KFF) (2021). 2021 Employer Health Benefits Survey. Nov. 10 Summary of Findings – 9805 | KFF

O’Leary, Chris and Stephen Wandner (2000). Unemployment Compensation and Older Workers. Prepared for the National Academy of Social Insurance conference.

U.S. GAO (2017).

Vallas, Rebecca and Christian Weller (2019). Bridge Benefit for Older Workers.

White, Elizabeth (2021). Testimony to the United States Senate Special Committee on Aging “A Changing Workforce: Supporting Older Workers Amid the COVID-19 Pandemic and Beyond.” April 29, 2021.

dddddddddddddddddd