By:

Published: August, 2022

How did the U.S. social insurance system perform during the first two years of the COVID-19 pandemic? Could we have done better?

Social insurance programs provided critical support during the pandemic.

Millions of people across the country rely on social insurance programs, which expanded to protect millions more during the pandemic.

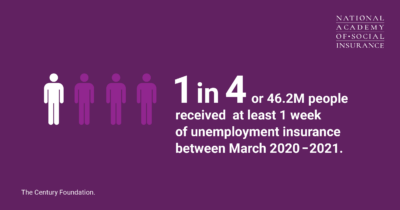

Unemployment Insurance (UI) supported jobless workers.

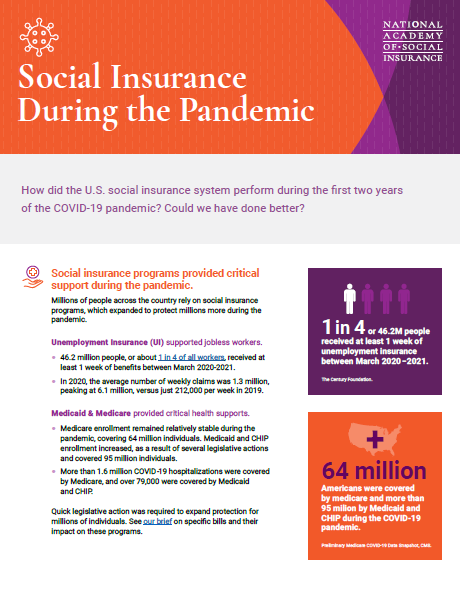

- 46.2 million people, or about 1 in 4 of all workers, received at least 1 week of benefits between March 2020-2021.

- In 2020, the average number of weekly claims was 1.3 million, peaking at 6.1 million, versus just 212,000 per week in 2019.

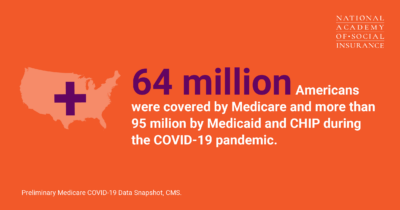

Medicaid & Medicare provided critical health supports.

- Medicare enrollment remained relatively stable during the pandemic, covering 64 million individuals. Medicaid and CHIP enrollment increased as a result of several legislative actions and covered 95 million individuals.

- More than 1.6 million COVID-19 hospitalizations were covered by Medicare, and over 79,000 were covered by Medicaid and CHIP.

Quick legislative action was required to expand protection for millions of individuals. See our brief on specific bills and their impact on these programs.

The pandemic also exposed long-existent gaps in social insurance.

Increased demand magnified and exacerbated existing weaknesses.

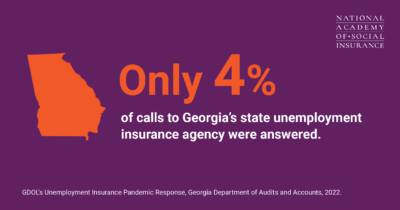

Unemployment Insurance (UI) proved outdated and underfunded.

- Outdated technology caused system crashes nationwide early in the pandemic. In Florida, jobless workers were advised to file paper claims, while in Georgia, only 4% of calls were answered.

- As of September 2020, 40% of UI claimants had not yet received their first checks. Systemic underfunding meant applicants waited an average of 6–7 weeks after approval to receive benefits, which left millions with no way to pay rent or buy food.

Workers’ Compensation proved to be poorly designed for this type of crisis.

- Only 17 states amended their laws to create presumptions for COVID-19, and most made exceptions only for healthcare workers and first responders. This left the vast majority of “essential workers” without protection.

- There was mass denial of claims within the hard-hit meat-packing industry. In Minnesota, all 935 workers’ compensation claims within that industry were denied.

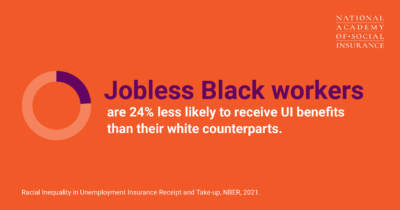

Racial and gender disparities abounded.

Workers of color were disproportionately affected by the pandemic.

- Jobless Black workers were 24% less likely to receive UI benefits than their white counterparts.

- Latinos comprised more than half of all meatpacking workers in one of the most affected and least protected industries.

The Bottom Line

Even when much of the world stopped, social insurance programs continued to provide critically needed support. To improve economic security and ensure that all workers are well protected, however, these programs must be strengthened, including potentially making temporary expansions permanent.

The Pathways to Economic Security toolkit a series of resources, including this fact sheet, to provide policymakers, advocates, administrators, and other stakeholders with key facts to help improve the social insurance programs that protected millions of Americans during the pandemic. Learn more about the COVID-19 Task Force Policy Translation Working Group. This Task Force is part of the Academy’s Pathways to Economic Security campaign.

dddddddddddddddddd