Dean Baker and Nicole Woo, Center for Economic and Policy Research (CEPR)

The 2011-12 Social Security payroll tax holiday ended in January 2013, which meant that the vast majority of working Americans faced a two percent cut in their take-home pay.

Compared to past payroll tax increases, this was an extraordinarily large and sudden one. For example, from 1980 to 1990 the rate was increased gradually by a total of 2.24 percentage points; in no year did the rate rise by more than 0.72 percentage points, or just over one-third of the 2013 increase. (This combines the employer and employee side tax increases. In 2013, the whole tax increase was on the employee side.)

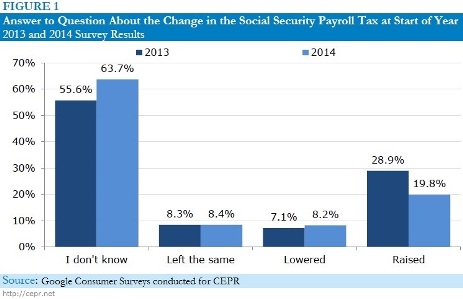

If the public were strongly opposed to tax increases, it would be expected that one as large as in 2013 would lead to considerable anger. This is why it was striking to find that most people apparently did not even notice that the payroll tax had gone up. In a 2013 Google Consumer Survey, CEPR asked whether the Social Security tax had been raised, lowered, or left the same at the beginning of the year. A majority answered that they didn’t know. Less than 3 out of 10 correctly answered that the tax had gone up.

In addition, this result likely overstates the share of the public that actually recognized the tax increase. Presumably some people answered that the tax had increased simply because they generally believe that government raises taxes. To get a sense of the size of this portion of respondents, we asked the same question in 2014. This year, almost 2-in-10 people incorrectly answered that their payroll taxes had increased at the beginning of 2014. The figure below shows the distribution of answers to the question in both years.

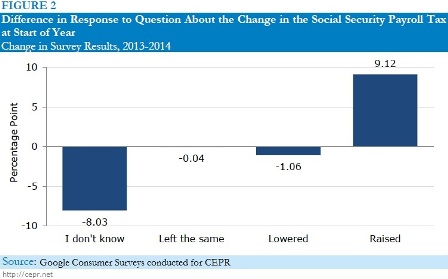

Let’s assume that the respondents who erroneously said that the tax increased in 2014 gives us a rough estimate of the number of people who believe that taxes rise regardless of the facts. Then we can estimate that the share of the public who actually noticed the tax increase would be the difference between the number who said the tax had increased in 2013 and those who said, incorrectly, that the tax had increased the following year. This figure shows the differences between the answers in the two years.

The difference between the percentage of respondents who said that the tax had increased in 2013 and those who answered similarly in 2014 was 9 percentage points. This means that less than 1 in 10 people surveyed were able to recognize an unusually large increase in the payroll tax.

This has interesting policy implications. When looking at ways to reduce Social Security’s projected funding shortfall, very few political leaders have been willing to propose any increase in the payroll tax, not even one slowly phased in over decades. For example, if a two percentage point increase in the payroll tax were phased in over twenty years, the rate would go up by only one-tenth of a percentage point per year.

These survey results suggest that the public may not be especially adverse to a modest increase in the payroll tax, since they may not even notice it. This supports the findings of other polls that indicate that most Americans favor strengthening Social Security through revenue increases, such as raising the payroll tax rate or the cap on taxable wages.

The 2013 payroll tax increase occurred in an environment in which no major political leaders were arguing against it. It was part of a bi-partisan budget agreement between the President and Congress, so both political parties had agreed to this tax increase. The public response likely would have been different if some political leaders had been openly arguing against it.

In other words, these survey results suggest that the obstacles to implementing a gradual payroll tax increase to reduce Social Security’s projected funding shortfall reside in the decisions of political leaders, and how the media choose to report them, rather than any inherent public opposition to higher taxes.

Let’s face it: The public cannot be too upset by tax increases if they don’t even notice when they take place.

The retirement age increase

The retirement age increase that began in 2000 also had a non-response from the public, even though raising the retirement age is generally pretty unpopular. In both cases, the change might have been seen as a “done deal” and so not worth getting worked up over. But propose either a retirement age increase or a payroll tax increase prospectively and I bet you’ll get a different reaction.

If I use a coupon when

If I use a coupon when purchasing an item one day and come back to acquire a second item the next day at the full price without a coupon, I can’t say the price of the item went up. The price was always the same. My coupon was a short term discount, a gift or an incentive. The public seems to agree, they new the underlying cost was always the same, they just received a small incentive to stimulate the economy.

To Biggs:

Since these

To Biggs:

Since these surveys indicate that the vast majority of the public did not even notice the payroll tax increase, it’s hard to see how they could see it as a “done deal.” In contrast, it seems that most folks have noticed the increase in the retirement age.

Not to mention distributional issues: increasing the Full Retirement Age disproportionately burdens lower-income, less-educated workers who are more likely to need to retire early and have lower life expectancies, and who also happen to rely most on Social Security retirement benefits.

See http://www.cepr.net/index.php/publications/reports/patterns-in-physically-demanding-labor-among-older-workers

To Sokol:

According to polling when Congress was considering whether or not to extend the 2011 payroll tax cut through 2012, the public also didn’t seem to notice that they got a discount in the first place. It seems unclear that they would consider the payroll tax cut only a short-term discount when it seems they never realized that they got it at all.

See http://thehill.com/polls/207261-the-hill-poll-no-benefit-from-tax-holiday-say-a-majority-of-us-voters

You want a modest increase in

You want a modest increase in the payroll tax to pay for Social Security. Okay, at some point Congress must replenish the Transportation Trust Fund with a modest increase in the gas tax. The D.C. area water company, WSSC, proposed a modest increase in water bills to pay for water pipe and sewer upgrades. Interest rates can’t remain this low forever so at some point a modest interest rate increase will come. State and local governments will probably want a modest tax increase to fund underfunded pension plans.

These modest increases will add up.

RE Biggs

I have to say I

RE Biggs

I have to say I think Biggs is pretty cynical. One difference between raising the tax 2% and raising the retirement age is that the tax increase does not materially affect anyone’s life style. Raising the retirement age is cruel and stupid. If people are paying for their own retirement, as they are with Social Security.. in spite of ignorant… or cynical… arguments to the contrary… then it shouldn’t matter to anyone that they prefer to raise their taxes than to have their retirement age increased.

Moreover, when the retirement age was increased in 1983 there wasn’t much “press” about it, and while the tax increase was visible in every paycheck that workers received for the next 30 years, the retirement age increase was not.

RE Phil Gilliam

the two percent (each) increase that Baker is talking about should fix Social Security finances for at least the next 75 years… that is NOT “adding up.” If the Social Security “tax” ever becomes more than it is worth to the workers they can cut it at that time if they are willing to accept the then necessary benefit cuts. But this will only happen if there is some honesty in the politics at that time. Something we do not have at this time.

NEWS FLASNH STOP GIVING

NEWS FLASNH STOP GIVING SOCIAL SECURITY TO IMMIGRANTS. MY {ITALIAN CAME OVER HERE FROM ITALY} AND GOT JOBS!!!!!!!STOPPPPPPPPPPPPPPPPPPP!!!!!!!! I PAID ALL MY LIFE INTO SOCIAL SECURITY AND MEDICARE!!!!!!!!!!!!!!! STOPPPPPPPPPPPPPPPPP USING IT FOR WARS IT IS NOT YOUR MONEY TO USE!!!!!!!!!!!!!!!!!!!!! THIS IS NOT A COMPLETLY FREE COUNTRY. STOP USING MY MONEY. YOU ARE SCARING THE RETIRED SENIORS . SHAME ON YOU YOU RICH B——S