Virginia P. Reno, National Academy of Social Insurance

The National Academy of Social Insurance joins more than 1,000 organizations nationwide during America Saves Week, February 24-28, with a public education initiative to help Americans boost their financial security.

The Academy’s new toolkit, When to Take Social Security: It Pays to Wait, explains how waiting to take Social Security retirement benefits, if you can, will increase your monthly benefit by as much as 76 percent. Key messages are:

- If you need Social Security to make ends meet, take it – you’ve earned it.

- But if you can wait, even a year or two, your monthly benefit will be higher – for the rest of your life.

- If you’re married, you have two lives to plan for – and chances are, either you or your spouse will live past age 85 or 90. If you are the higher earner, waiting to take Social Security means providing a higher survivor benefit for your spouse if she or he outlives you.

The toolkit is available online at www.nasi.org/when-to-take-social-security-it-pays-to-wait/ and includes:

- A 3-minute video: Social Security: It Pays To Wait

- A one-page fact sheet: When Should I Take Social Security?

- A colorful 16-page brief: When Should I Take Social Security? Questions to Consider

How important will Social Security be for you?

While Social Security retirement benefits are modest – an average of $1,296 a month in January 2014 – they are the most important retirement asset most Americans have. Many pre-retirees have limited personal savings. For example, the latest Survey of Consumer Finances finds that 7 in 10 householders age 55 to 64 had less than $100,000 in retirement accounts in 2010. They include 4 in 10 who had no retirement accounts and 3 in 10 whose account balances were less than $100,000.[1]

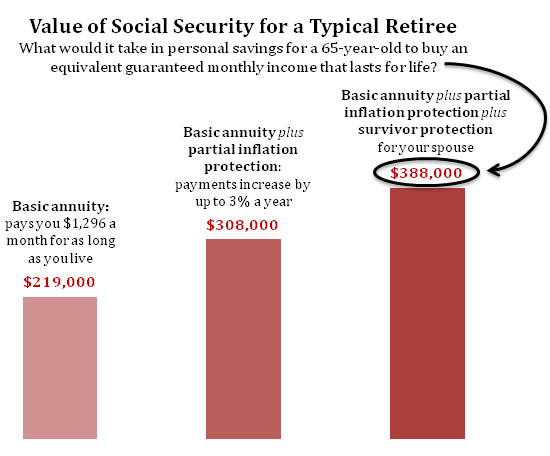

The importance of Social Security becomes clear when we estimate what it would cost a 65-year-old to buy a guaranteed monthly income equal to the average Social Security benefit. To buy an annuity – a private insurance policy that would pay $1,296 a month starting at 65 for the rest of your life – you would need to pay the insurance company about $219,000 in cash up front.[2] If you wanted partial protection against inflation – a guarantee that your payment would increase by up to 3 percent per year for the rest of your life – the up-front price would increase to $308,000. If you also wanted to ensure that payments would continue for your 65-year-old spouse after you die, for as long as your spouse lives, the up-front price would rise to $388,000.

These dollar figures – which far exceed the retirement savings of most Americans – indicate the value of the retirement income protection that Social Security provides for a typical retiree. When you think of Social Security as your most important retirement asset, you may want to think carefully about increasing it by delaying when you start benefits, if you can.

Visit www.nasi.org/WhenToTakeSocialSecurity to learn more.

[1] Bricker, et. al. “Changes in U.S. Family Finances from 2007 to 2010: Evidence from the Survey of Consumer Finances,” Federal Reserve Bulletin, June 2012 (pp 28 and 30).

[2] Estimates are derived from the Retirement Income Calculator of the U.S. Thrift Savings Plan at https://www.tsp.gov/planningtools/retirementcalculator/retirementCalculator.shtml, which assumed a 3.0 percent interest rate in February 2014.

I read the 16-page brief:

I read the 16-page brief: When Should I Take Social Security? Questions to Consider – I have a question for which I have not been able to find an adequate answer. Your brief indicates the following:

– Social Security benefits are based on a person’s highest 35 years of income.

– “If you are retired or out of work and are fortunate enough to have other resources that you could live on […] you may want to consider spending down part of those resources while waiting to take Social Security. […] some individuals can tap other investments in order to provide “bridge income” from the time they retire until they are able to maximize their Social Security benefits.”

How are these two statements reconciled? As far as I know, investment income is not taxed for social security purposes. If a person retires at 66, does not start collecting social security, and does not have any income that will be taxed for social security, how would their benefits increase (beyond COLA)?

Thank you for any clarification that you can provide.

-Kirk

Hi Kirk,

Good question. You

Hi Kirk,

Good question. You are correct that Social Security benefits are based on the individual’s highest 35 years of earnings, i.e. income (from working) that is covered and taxed for Social Security purposes. So that does not include income from investments or other non-wage sources, nor does it include wage earnings over Social Security’s annual cap on taxable earnings (which is $117,000 in 2014).

Now to answer your question: Whether or not a person is working after his full retirement age (now 66), if he delays taking Social Security his benefit will be increased because of the delayed retirement credit (8% a year or 2/3 of 1% a month) up to age 70. For more on this, see Figure 1 on page 3 of the brief, under “How much difference does it make to wait?”

Hope this helps. If you have further questions, you can contact me at ewalker[at]nasi.org.

Best,

Elisa Walker, NASI

Please discuss the little

Please discuss the little known option for those currently receiving early benefits to suspend those benefits at age 66 and resume at 70. Basically, benefits will increase by 8% per year and the decision can be reversed retroactively if those suspended benefits are later needed.

I’d like to hear opinions, pro and con, for a retired male, 65, with pension + social security, 16k + 16k and currently taking 3-4% from portfolio. Suspending benefits would require taking an additional 3-4% for 4 years, i.e. 6-8%. Please discuss the “time value for money” and the financial effect of depleting the portfolio during these “best of life” active 4 years. Thanks.

Regards,

August 24, 2014

I’m receiving Spousal

I’m receiving Spousal Benefits from my deceased husband. Will I be eligible for increase/inflation payment? My friends that are on non spousal benefits have gotten a increase.

Thank you