Elisa Walker, National Academy of Social Insurance

The Social Security Administration announced today that beneficiaries will see a 1.5% cost-of-living adjustment (COLA) beginning in their January 2014 checks. Benefits are automatically adjusted to keep up with the cost of living.

Key points:

- The COLA for 2014 will be 1.5% — slightly below last year’s COLA of 1.7%, and below the average of 2.7% since 1990.

- The increase will become effective with December 2013 benefits, payable in January 2014.

- The COLA calculation is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), produced by the Bureau of Labor Statistics (BLS).

- Earnings subject to Social Security taxes will be capped at $117,000 in 2014, compared to $113,700 in 2013. About 6 percent of workers have earnings above the cap.

For more information on the CPI data and the COLA calculation, see information provided by the Bureau of Labor Statistics and the Social Security Administration.

Should Social Security’s Cost-of-Living Adjustment Be Changed?

Some policymakers have suggested changing how the COLA is calculated. NASI’s fact sheet, Should Social Security’s Cost-of-Living Adjustment Be Changed?, describes two alternative inflation measures:

- The chained CPI is sometimes said to be a more accurate measure of inflation for the average consumer, but it understates the inflation experienced by seniors and disabled Americans, who make up the majority of Social Security beneficiaries. They have relatively high out-of-pocket healthcare costs and limited ability to make substitutions (such as fuel for food) when prices rise. Switching to a chained CPI would cut Social Security benefits for current and future beneficiaries by gradually eroding their purchasing power over time. On average, the chained CPI grows about 0.3 percentage points more slowly per year than the current COLA. A National Women’s Law Center report finds that the cumulative losses by age 95 for a retiree with average earnings would be nearly $25,000.

- The CPI-E, an experimental price index for the elderly, more accurately measures the inflation actually experienced by elderly Americans. On average, the CPI-E rises about 0.2 percentage points faster than the current CPI. It would slightly increase the COLA.

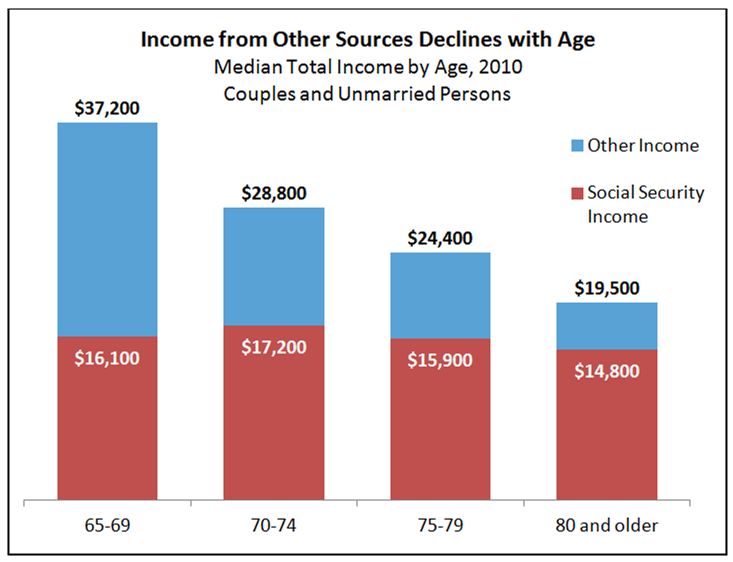

The oldest Americans would experience the biggest changes, whether in seeing benefits cut by the chained CPI or increased by the CPI-E. Because Social Security becomes increasingly important at advanced ages as income declines from other sources (such as pensions and savings), even minor erosion of the purchasing power of benefits is a public policy concern.

President Obama and some members of Congress have suggested switching to the chained CPI for the entire federal budget, including Social Security. This would reduce benefits from programs like Social Security while increasing revenues through the tax code. A second NASI fact sheet, How Would Shifting to a Chained CPI Affect the Federal Budget?, finds that over the next decade, nearly two-thirds of the total impact would come from cuts in Social Security, veterans’ benefits, federal pensions and Supplemental Security Income, while one third would come from increased general revenues.

When Americans are asked about the Social Security policy changes they want to see, most say they prefer to increase, rather than reduce, the COLA. NASI’s recent public opinion study, Strengthening Social Security: What Do Americans Want?, found that 64% of Americans favored increasing the COLA by using the CPI-E to calculate it. A NASI blog post further explores public opinions on the COLA.

Using the chained CPI for the

Using the chained CPI for the Social Security COLA is a poor idea in this time of shrinking or non-existent pension plans. Social Security would be better served by using the CPI-U because it is more accurate than the CPI-W and, at the same time, would cost little or nothing to implement. Also, calculating the COLA on the basis of 3rd quarter CPI averages was never well thought out when Social Security moved from table-based PIAs to AIME-based PIAs, because, under current law, some cohorts get undeserved high COLAs while others may get none. This could be fixed by basing COLAs on fiscal year CPI averages or sums. This is a bit too complicated to explain here, but I can give a thorough explanation if anyone is interested. The long-range cost of my proposal is zero, but it could have short-range costs or savings depending on exactly how it would be implemented.