By:

Published: August, 2023

The Social Security program – composed of the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) programs – has been a pillar of financial security for older adults, people with disabilities, and many of their dependents in the United States.

The Impact of COVID-19 on Older Adults and People with Disabilities

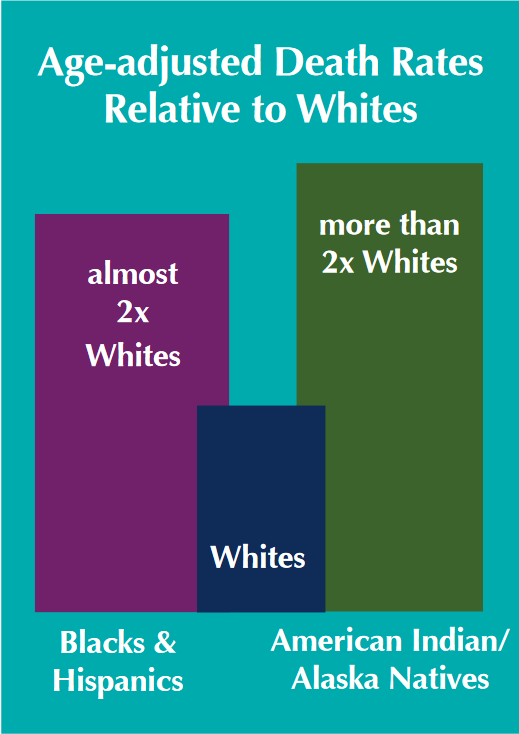

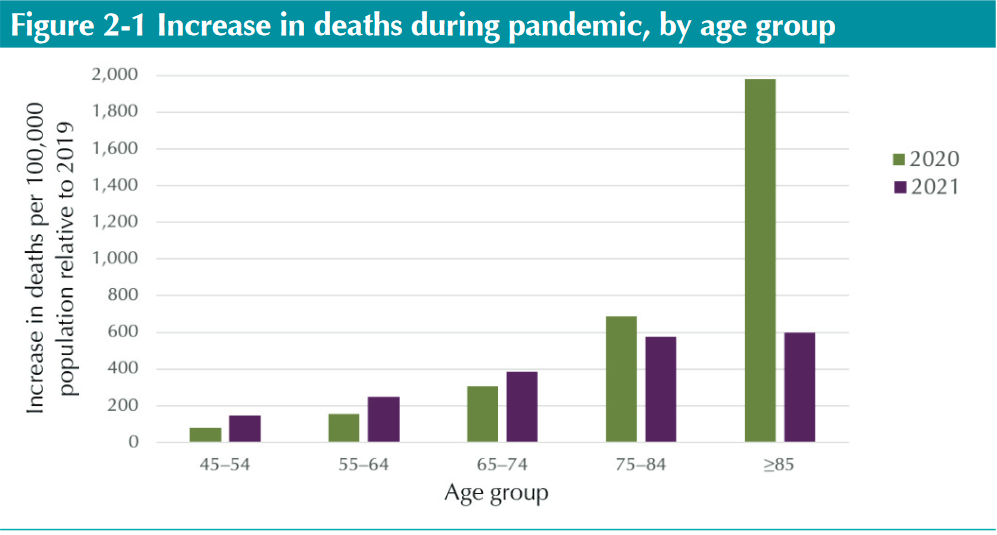

There was a one percent (1%) increase in deaths for older adults aged 65+ in both 2020 and 2021 compared to projections based on 2019 rates. Age-adjusted death rates for Blacks and Hispanics were almost double that for Whites, and among American Indian/Alaska Natives were more than double.

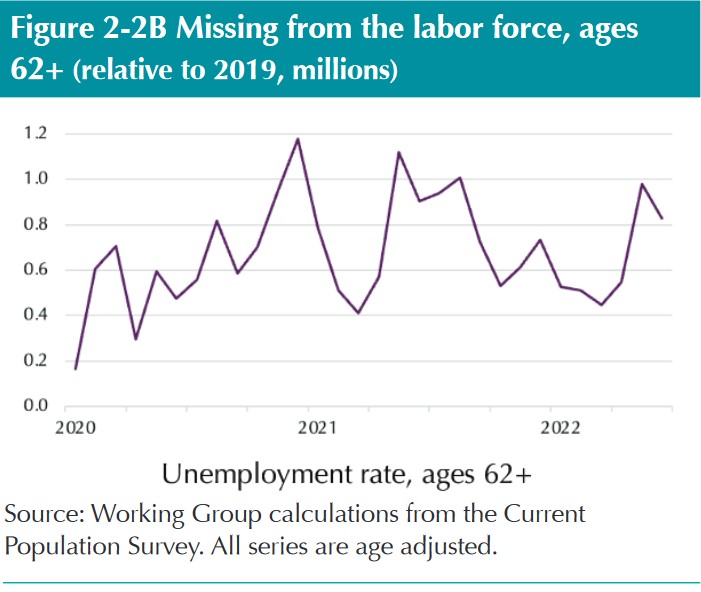

The COVID-19 pandemic led older workers to leave the workforce at a significantly higher rate than younger workers. There was a 1.2% drop in people aged 62+ who were working or looking for a job between August 2019 and August 2022.

Unlike during the Great Recession and other previous economic downturns, the rate of claims to the Disability Insurance program has not yet increased significantly since the start of the pandemic. It is unclear whether or not this will remain true over the long-term, as there is not yet clarity on whether DI applications and claims will increase (or not) as a result of the impact of long- COVID on the workforce.

The Impact of COVID-19 on the Financial Condition of Social Security

Unemployment Insurance (UI)

While the COVID-induced recession did have a negative impact on Social Security’s finances, the sudden and significant uptick in premature mortality (over 1.1 million excess deaths to date) – which was disproportionately concentrated among older adults – lowered projected costs overall.

The rate of Social Security claims during the pandemic remained relatively flat for a variety of reasons:

- Many older workers who fell out of the workforce were already claimants who were supplementing their income with their OASI benefits.

- Applications and claims for DI also did not increase, in part because many who became unemployed during the pandemic were eligible for Unemployment Insurance (UI) or other pandemic- related assistance programs.

- The closure of in-person Social Security Administration (SSA) offices likely impacted the number of new applications for both the OASI and DI programs.

- – Applicants who needed the highest degree of assistance (e.g., older applicants) were likely the most negatively impacted by the loss of in-person support.

- – There was a disproportionate impact on disadvantaged communities due to the digital and technological divide in access to tools, such as computers, the internet, and cell phones.

- – Applicants were required to submit original copies of vital documents via mail or drop boxes without any guarantee of when they would be returned.

- Workers may have elected to claim benefits from other financial assistance programs that were either new or expanded (e.g., Unemployment Insurance) in response to the COVID-19 pandemic, which in turn may have allowed them to put off claiming Social Security benefits.

As a result, the COVID-19 pandemic ultimately had negligible effects on the long-term projected financial condition of the overall program.

The longer-term impact of the pandemic specifically on DI claims remains unclear particularly in light of the uncertain impact of “long COVID.” The degree and severity of the effects of long COVID on the DI program remain unknown, as we still do not have enough data or information on the percentage of individuals who will develop long COVID, the longevity and severity of those cases, or whether or not DI will consider individuals living with long COVID eligible for benefits – all of which will have an impact on the number of DI claims that will be made as a direct result of long COVID.

Lessons Learned and Policy Solutions

- Modify the formula for calculating the National Average Wage Index (AWI). [Option 2.A.1]

Most simply, reductions in the AWI could be banned during periods of high unemployment – either for all retirees or possibly just for low lifetime earners. - Make adjustments for early vs. delayed claims. [Option 2.A.2]

The formula for claiming benefits could be modified so that it doesn’t penalize early claimers, who have disproportionately lower lifetime earnings. For early claimants, benefit rates are so much lower that they receive less over the lifetime of their benefit than those who can delay making their claims. - Ensure that administrative challenges don’t impair access to benefits. [Option 2.A.3]

With increased federal funding, the SSA could consider extending hours, increasing staffing, and/or increasing the number of appointments available to catch up on the applications that became back-logged during the period of SSA office closures. - Investigate the relationship between Unemployment Insurance and other programs on Social Security retirement (OASI) and disability (DI) claims. [Option 2.A.4]

Unemployment Insurance and other pandemic assistance programs allowed some older workers who fell out of the workforce due to the pandemic to delay claiming their OASI benefits, which in turn improves the benefits received by claimants over the lifetime. Additionally, because most people who are awarded DI never return to the workplace, the provision of substantial but temporary UI benefits might encourage fewer people to leave the workforce long-term during future epidemics or other public health crises.

dddddddddddddddddd