As part of a larger series titled ‘Insult to Injury: America’s Vanishing Worker Protections,’ ProPublica and NPR recently published three investigative reports:

- ‘The Demolition of Workers’ Comp’;

- ‘How Much is your Arm Worth? Depends on Where You Work;’ and

- ‘The Fallout of Workers’ Comp ‘Reform’: 5 Tales of Harm

In response, The Insurance Information Institute (I.I.I) sent a letter challenging parts of the articles. ProPublica and NPR published a follow-up: ‘Insurance Information Institute Challenges our Workers’ Compensation Investigation. We Respond’. It’s worthwhile to read both the III letter and the response.

The journalists had spoken to a number of Academy members while researching the articles. Below we present a discuss post by Marjorie Baldwin, Professor, Arizona State University, and Chair of the Study Panel on Workers’ Compensation Data of the National Academy of Social Insurance.

Workers’ Compensation: Critical Questions, Elusive Answers

By Marjorie Baldwin

ProPublica and NPR have recently published three investigative reports as part of a series titled ‘Insult to Injury: America’s Vanishing Worker Protections.’ The articles report that since 2003, more than 30 states have cut workers’ compensation benefits, making it more difficult for injured workers to obtain medical care and shifting the costs from workers’ compensation to other programs, namely, Social Security Disability Insurance, Medicare, and Medicaid.

The ProPublica and NPR reports make it appear that workers’ compensation is a badly broken system being wrecked by state governments eager to reduce employer costs in order to attract business from other states. But do the articles present a fair and balanced assessment of the state of workers’ compensation today?

Much of the reporting relies on horrific stories of individual workers who have been badly injured on the job and had to battle their state workers’ compensation systems to obtain the medical care and wage benefits they desperately need and justly deserve. The stories are tragic and should never happen. A fundamental purpose of the workers’ compensation system is to provide full and immediate relief — in medical care and compensation for wage losses — to injured workers and their families. The problem with relying on individual stories as evidence, however, is that there are always stories that portray a counter-perspective. In workers’ compensation, these are stories of (the small minority) of workers who abuse the system by falsifying claims or magnifying the effects of their injuries.

So let’s move beyond the individual stories and examine the evidence presented in the ProPublica and NPR reports. Is it fair, balanced, and complete? Unfortunately, much of the evidence is vague and therefore non-refutable. For example, “state after state has been dismantling America’s workers’ compensation system with disastrous consequences for many of the hundreds of thousands of people who suffer serious injuries at work each year.” How many is many? 100? 100,000? The majority?

Other evidence presented in the reports is incomplete, and gives a skewed picture of the system. For example, the report tells us, “In 37 states, workers can’t pick their own doctor or are restricted to a list provided by their employers.” The report does not tell us that in at least 10 of those states, workers may switch to a doctor of their choice after their first visit, and their medical costs will still be covered 100%.

Finally, in citing evidence that condemns the workers’ compensation system, the authors of the ProPublica and NPR report do not explore other possible explanations for the trends they identify. For example, “employers are paying the lowest rates for workers’ compensation insurance since the 1970s… all the while, employers have found someone else to foot the bill for workplace accidents.” However, one of the recent trends in the workers’ compensation insurance market is toward more ‘high-deductible’ insurance plans. Just as with individual health insurance or automobile insurance, when you choose a high- deductible plan your premium rates go down. But you are not shifting costs to others; you are assuming more of the risk yourself.

In raising these points, I am not attempting to defend the state workers’ compensation systems against all criticism. Assessing the adequacy of benefits paid to injured workers is an ongoing challenge to those of us who grub around in workers’ compensation data on a regular basis. But I am asserting that the stakeholders in the system — injured workers, employers, insurers, state governments, and the public — deserve a more informative accounting of how the system performs than the ProPublica and NPR reports provide.

Presenting a balanced picture drawn from the most recent available data is the task that the National Academy of Social Insurance has assumed for the past 17 years. The Academy’s annual report, Workers’ Compensation: Benefits, Coverage, and Costs, provides reliable state-by-state data on workers’ compensation systems nationwide. The report is the only comprehensive nationwide compilation of its kind and is produced with the guidance of a national expert panel representing all key stakeholder groups: labor, government, business, and academia.

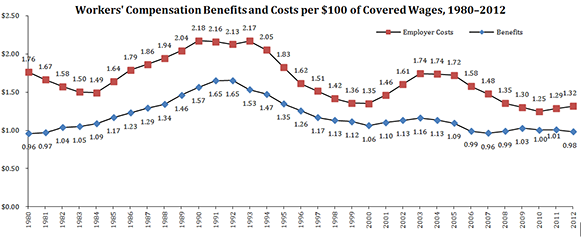

What does the latest report show? In 2012, the most recent year for which data are available, workers’ compensation benefits rose by 1.3 percent to $61.9 billion, while employer costs rose by 6.9 percent to $83.2 billion. However, workers’ compensation benefits and costs tend to be pro-cyclical, that is, increasing in periods of expansion (as employment grows) and decreasing in periods of recession (as employment contracts). In examining trends over time, therefore, the Academy considers benefits and costs as a share of total wages. Between 2006 and 2012 benefits per $100 of wages were in fact, lower than at any time since 1980-81.

The figure below (Figure 1 in the Academy’s report) shows the 30-year trends in workers’ compensation benefits and employer costs as a share of wages.

Is the downward trend in employer costs the result of safer workplaces, or of states’ legislative and regulatory tightening of eligibility rules?

The answer is not simple. In general, workplaces are certainly safer than in the past — for a variety of reasons, including the fact that fewer workers are employed in high-risk industries such as mining, fishing, and construction. But it is also true that states have sought to curb the rising cost of medical payments, which now account for about 50 percent of total workers’ compensation costs. As states seek to rein in medical costs, a complicating factor, according to some experts, is that most cases are “medical-only,” meaning that the injury does not require days away from work. That may explain, at least to some extent, the decline in the share of wage replacement payments in recent years.

Workers’ compensation provides essential insurance protection for injured and ill workers. Unlike other social insurance programs, however, workers’ compensation programs are regulated by states. There are no federal standards for reporting coverage and benefits. That is why — as the ProPublica and NPR series reported — levels of worker protection can vary substantially from state to state, resulting in significant disparities in benefit payments and duration of benefits for the same injury for workers living a few miles apart but across state lines.

The ProPublica and NPR series does raise important issues. Should state workers’ compensation programs be subject to federal standards? Are workers with the most serious injuries adequately compensated? Oklahoma recently passed legislation making it the second state — after Texas — to allow employers to opt out of the state’s workers’ compensation system. With respect to opting-out, does implementation of the Affordable Care Act (assuming it withstands all court challenges) mean that employer-sponsored healthcare should be integrated with workers’ compensation? Definitive answers to major questions such as these are elusive. There is no question, however, of the continuing need for close and objective scrutiny of workers’ compensation trends — a role that the National Academy of Social Insurance intends to fulfill.

There are a lot of nuances

There are a lot of nuances related to safety and the cost of medical benefits that may not have been covered in the NPR articles but they called attention to a fact that many people would like to ignore or cover up:

During the last 25 years virtually every state has passed bills making it harder for workers to qualify for benefits and reducing the amount of benefits for those who do qualify. Most states have done this repeatedly and many continue to do so to an even greater extent. They have done this even though during this time, unlike any other business related expense, employer costs for workers’ compensation have gone down.

It is time someone called the public’s attention to this situation.

Ed Welch

Margorie,

Your little

Margorie,

Your little article reads like it was written by the insurance industry. How can you equate the numerous cases of seriously injured workers getting screwed by workers’ compensation with the shibboleth of worker fraud. This is an old campaign by insurers and employers to discredit anyone who claims a work injury or illness with fraud. The numerous studies and evidence point to a much larger element of fraud on behalf of employers and insurers.

The current campaign in this country is to attack any thing that smacks of fair treatment of workers; just look at the increase in income disparity and the decline of the middle class.

Of course employers and insurers are never satisfied. They’ve certainly decimated the workers’ comp system AND the unemployment insurance system through the Koch Brothers-funded effort of their surrogate organization, the American Legislative Exchange Council (ALEC).

They love the protection afforded by workers’ comp “exclusive remedy,” they still don’t want to pay for it. Here’s an example of their latest: http://www.motherjones.com/politics/2015/03/arawc-walmart-campaign-against-workers-compensation.

Jim Ellenberger

I agree with Marjorie’s

I agree with Marjorie’s concern about ProPublica’s analysis via anecdote. But journalism’s about shining dramatic spotlights; legislation by anecdote is the more serious sin.

But I also believe Ed’s exactly right about the general drift of state WC legislation over the past 25 years, and the negative impact that’s had on injured workers. The ALEC strategy Jim points out is an indicator that many states may be heading even more aggressively down that path. It doesn’t seem accidental that this legislative trend to constrain benefits and worker rights corresponds so neatly with the decline in union membership.

A related NPR series focused on nurse injuries/illnesses caused by patient lifting. It highlighted that the Dept. of Veterans Affairs is now investing heavily in lifting technology to reduce injury risk, whereas many private hospitals are not. I’d like to think the relative generosity and fairness of OWCP’s administration of the Federal Employees’ Compensation Act — that “model statute” — had some part in bringing about that distinction between Federal and private employer behavior.

One last comment: the ProPublica “Demolition” piece notes that the Dept. of Labor stopped publishing its annual report on the states’ compliance with the National Commission’s recommendations in 2004 due to budget cuts. I can’t remember exactly when we at OWCP did that; John B probably will, and 2004 might be right. Budget cuts and retirement of the key staff who had sustained the report did precipitate its demise. But the report had become more or less pro forma long before then, and generated little or no attention, because Congressional appetite for Federal oversight of state WC systems was nil. The same constraints had earlier made it impossible for OWCP to pick up the Social Security WC benefits and costs time series when the SSA staffer who had compiled it for years retired. Luckily, John convinced NASI to step in and take over the latter report, and the rest is history.

Shelby Hallmark

As media investigations go,

As media investigations go, the effort was very good. If footnotes are required in order to confer validity to in depth articles such as ProPublica’s series, then that is a new requirement. I have witnessed these horrific studies first hand over my 40 years of law practice representing Employers, Insurers, and Injured Employees or their survivors. As a state judge and for a short term as chair of our Labor Commission, I rendered decisions which dealt with the misery such as described. For 31 years, responding to legislation impacting access to coverage and limitation of benefits once in the system, is part of my responsibility representing organized labor at a state level. Finally, as a former officer in my state trial lawyers association and as a founder and past president of Workers’ Injury Law & Advocacy Group, there is little that I can challenge in the series.

It appears to many of us that the dismantlement of the grand bargain began in the 1980’s, largely started by major insurance companies whose loss ratio exceeded 100%. The effort grew, and was fed in part by trade associations and special interest groups, each of which had anecdotal ideas on so-called reforms. The emphasis shifted from whether the program was delivering on its initial promises of prompt effective medical care and timely income replacement, to that of employer costs. Term limits enacted in various state legislatures resulted in the loss of institutional memory and the empowerment of those agenda driven groups which recruited and supported candidates.

Cost shifting from industry to the worker occurred with the demonization of the workers as fraud became a television phenomena despite evidence that such is not representative of the many. But the shaming of reporting of these injuries, coupled with Safety Bingo and similar programs, caused a serious under-reporting. More recent shifting examples are of the taxpayer subsidies of Medicare and Medicaid, as well as the correlation that Prof. Burton described in the greater use of SSDIB in states with lower total disability coverages.

We’ve experienced nationally shortened time limits, heightened burdens of proof, reductions to or eliminations of benefits because of fault, elimination of Second Injury Funds, use of various editions of impairment guidelines which with each iteration seemingly reduces corresponding levels of compensation. Add to this underfunding of the programs charged with administration, safety, and judicial determination–all of which has the obvious deleterious impact upon injury avoidance or timeliness of adjudication.

I applaud the past efforts of NASI’s investigations and annual surveys which fare well with peer review. Alas, state legislatures rarely rely upon the non-partisan scholarly works, and react with anecdote legislation even after access and benefits are restricted.

It would have been nice if

It would have been nice if Marjorie Baldwin would have stated up front NASI’s conflict of interest related to this topic: since Christine Baker Director of the DIR for the State of California is a sitting board member with this organization of policy plutocrats. Ms. Baker is a well known proponent of SB863 that has significantly curtailed and denied both medical care and benefits to the injured workers of California.

Ms. Baker and this organization appear to be simply pundits sitting on the sidelines of this ongoing social tragedy. This commentary reads like a chief insurance industry apologist spewing the same old tired rhetoric. It is organizations like this that have allowed us to get to this catastrophic juncture in workers compensation.

You do know what they say about statistics correct? you can make them (the numbers, statistics) say what ever you want them to say.

It’s past time for NASI to take off their industry supplied and paid for rose colored glasses, and take a long hard look at reality. This is not some philosophical topical or trivial narrative to sit around a table snipping tea over; this is unfair damage being done to real hard working citizen human beings; that currently are given no voice or power in which to seek a just remedy and care.

Of course the sad reality is that the very pundits making these grandiose proclamations related to how well workers’ compensation works from NASI; are the very same people that will never have to use or will they be subjected to the workers’ compensation system themselves.

I would only suggest that Ms. Baldwin just might want to get down out of that Ivory Tower and into the trenches with real injured parties to gain a much better prospective/understanding of our current reality and the state of workers compensation in America.

Hello,

My name is Kathy 53)

Hello,

My name is Kathy 53) and my husband, Chuck 53) was in a work related car accident in 1992 in California. He’s currently receiving benefits from Zenith WC Insurance Co

On the 1st of March this year my husband had to have spinal surgery at Kaiser hospital in Sacramento because his paralysis was going further up his body…he’s a C6-7 quadriplegic.

Zenith stopped Chuck’s 24 hour care before two weeks of being out of the hospital. He would need a prescription from the surgeon requiring 24 hour care. The 24 hour care has been reinstated until his next hospital appointment with the the surgeon on 4/11/17.

I googled WC Care and respite care to research our options. I came across Kathy Kristof’s article in the LA Times about spousal care and reimbursement. Chuck’s case is still open.

We submitted a request for care reimbursement last week and were denied…big surprise.

Prior to being married most days Chuck would eat dinner at his parents home. (His parents & sister live 2-3 miles from Chuck) On days He didn’t eat at his parents they would drop dinner off at his house or his attendant would put a sandwich in the refrigerator, in a plastic grocery bag so he could hook his thumb on the bag and pull it out of the refrigerator.

While living alone Chuck has fallen out of bed 3 different times…having to wait on the floor until an attendant arrives at 530 am to get him up.

I moved in with chuck in 2001 and we married April 2003 -If I were not with him or his family and friends were not here to help he would need 24 hours of care and assistance.

In addition:

Chuck and I have tried for years to get Zenith to pay for His injury (falls, chronic feet issues, 3 hospitals stays, ER visits..,that his private insurance (Kaiser) has paid for.

Each time we call to have Zenith set up care with Kaiser when he needs to be seen, the adjuster says she’ll do it… never happens. It’s only been this latest spinal surgery that I PUSHED HARD to get Zenith to be held accountable for his care. His adjuster tried every tactic to avoid having to pay …hoping the surgery would happen before paperwork got completed! It took 2 weeks calling every day to get approved.

Kaiser agreed to do the surgery and post-care only. Zenith wants to SHUT IT DOWN!

The adjuster also discussed with the Kaiser our options with doctors not affiliated with Kaiser!

Kaiser:

“Your adjuster tells me your husband has decided on a Doctor on J street”.

Zenith has been successful at keeping Chuck from choosing Kaiser in the past and now they’re making it difficult to move forward with Kaiser in the future.

We are scared, angry and disgusted,

Thank you,

Kathy O’